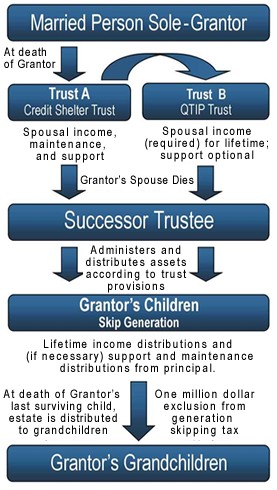

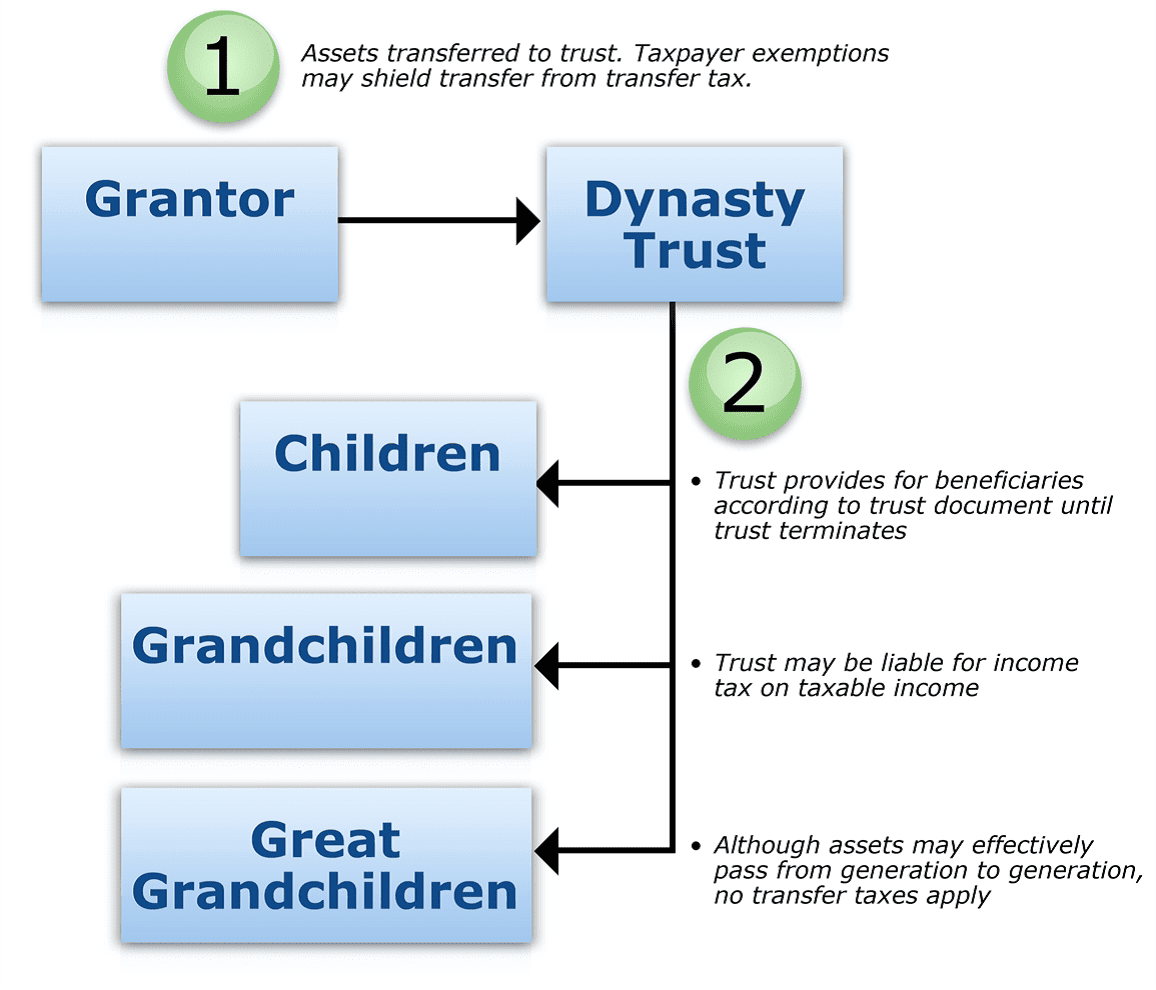

41 Generation Skipping Trust Diagram

Generation Skipping Trusts Explained - O'Flaherty Law A generation-skipping trust (GST), sometimes referred to as a “dynasty trust,” is exactly what it sounds like – a legally binding, specialized, irrevocable trust agreement in which a grantor’s assets are passed down to the grantor’s grandchildren (not children) to avoid estate tax liability. GSTs are designed to eliminate estate taxes at each generational level for as many generations as tolerated by applicable Illinois law. naszsen.pl With a selection of over 1,000,000 replacement batteries and accessories it can be overwhelming to find what you need. 0 Answers I race 92 eagle talon n i use 3 rd gear wide open seems too be skipping an loseimg power an skipping on Eagle pen torch assembly diagram Get the best Oral Cancer Treatment Cost in India in the TOP 20 Mouth Cancer Hospital in India. Animatronic …

PDF Generation - Skipping Trusts This trust can remain sheltered for an extended period of time (around 100 years). Even when the inheritance is relatively small (say, $100,000 to $200,000), the ability to protect these assets is valuable. A second but important benefit of the generation-skipping trust is the creditor-protection it affords to the heirs. Consider these points:

Generation skipping trust diagram

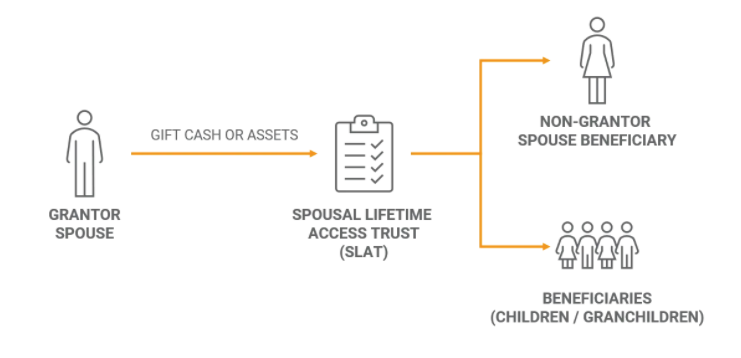

Generation-Skipping Trust—GST Definition A generation-skipping trust (GST) is a type of legally binding trust agreement in which the contributed assets are passed down to the grantor's grandchildren, thus "skipping" the next generation, the grantor's children. By passing over the grantor's children, the assets avoid the estate taxes—taxes on an individual's property upon his or her death—that would apply if the children directly inherited them. Generation-skipping trusts are effective wealth-preservation tools for individuals with significant assets and savings. PDF Spousal Lifetime Access Trusts - Morgan Stanley The trust further could be shielded by the donor-spouse's generation-skipping transfer (GST) tax exemption if intended for grandchildren and more remote descendants. • The assets transferred to the trust by the donor should be made from the donor's separate property and not from jointly titled or Home - Marketing Charts How Much Do People Trust Advertising? Fewer than 1 in 10 global consumers automatically assume the information in advertising is true. US Consumer Spending on the Video Game Industry Grew by 8% Last Year

Generation skipping trust diagram. Generation Skipping Trusts - Wealth Retention Services A generation-skipping trust works well when a person wants to avoid compounding a child's estate tax problem or when a child cannot make his or her own ... PDF Internal Revenue Service Department of the Treasury Residuary Trust. The Marital Trust is to be further divided into two separate trusts, the Marital Exempt Trust and the Marital Non-Exempt Trust, if the executor makes the election under section 2652(a)(3). The Form 706, United States Estate (and Generation-Skipping Transfer) Tax return, was timely filed on Date 4. Generational Skip Trust - Fill Out and Sign Printable PDF ... How to fill out the Generation skipping trust form on the internet: To start the blank, use the Fill & Sign Online button or tick the preview image of the blank. The advanced tools of the editor will guide you through the editable PDF template. Enter your official contact and identification details. Use a check mark to indicate the choice ... Updated 2019 - Generation Skipping Transfer: Trusts and Taxes The Current Law. Thanks to recent changes in the tax law, each person may now transfer approximately $11.2 million free of this generation skipping tax. For a married couple, the amount is effectively $22.4 million. The maximum tax rate for GST, Gift and Estate taxes is now 40%. Combined Tax Rates. In the event GST tax is imposed together with ...

What is a Generation Skipping Trust? - CMRS Law If we had established a Generation Skipping Trust for her benefit at her parents' deaths, funded with $2,000,000, and this trust, after accounting for any distributions the child makes from the trust, grew at 5%, then in thirty years, the Trust would be worth approximately $9,000,000. The fact that this is in a Generation Skipping Trust rather PDF Advanced Trust Planning (and designing the Perfect ... The generation skipping tax exemption is $5,450,000 (adjusted for inflation each year) as is the gift tax exclusion exemption. In the case of a transfer to a trust which will continue for one or more generation members below that of the grantor, a gift tax return should be filed and generation skipping tax exemption shall be allocation. Credit shelter trusts and estate taxes | Learn more | Fidelity Therefore, without the use of a CST, any unused state estate tax exclusion and generation-skipping transfer tax exclusion of the first spouse to die will be lost. Assets contained in a trust are generally protected from the beneficiary's creditors. Sister of Tupac Shakur Sues Trust Over Embezzlement ... Sekyiwa Shakur, the "last surviving child" of Tupac's mother, Afeni Shakur Davis, just recently submitted the petition to a California federal court. Afeni Shakur Davis, the founder of the ...

Dynasty Trust - SmartDraw A Dynasty Trust is a trust that continues for approximately 100 years or longer and provides payments to future generations, without any additional estate or generation-skipping transfer taxes. This is different from the standard estate plan whereby husband and wife usually leave all of their assets outright to their children equally when the ... Generation-Skipping Transfer Tax—GSTT Generation-skipping transfer taxes serve the purpose of ensuring that taxes are paid when assets are placed in a trust, and the beneficiary receives amounts in excess of the generation-skipping ... Trust law - Wikipedia Dynasty trust (also known as a 'generation-skipping trust'): A type of trust in which assets are passed down to the grantor's grandchildren, not the grantor's children. The children of the grantor never take title to the assets. This allows the grantor to avoid the estate taxes that would apply if the assets were transferred to his or her children first. Generation-skipping trusts can still be ... PDF Spousal Lifetime Access Trust (Slat) - Nfp commercial lender. The SLAT can be drafted as a defective grantor trust, which leaves the grantor still paying the income taxes on the trust's assets, or as a dynasty trust, which utilizes the donor's generation-skipping transfer (GST) tax exemption. It is important to also note

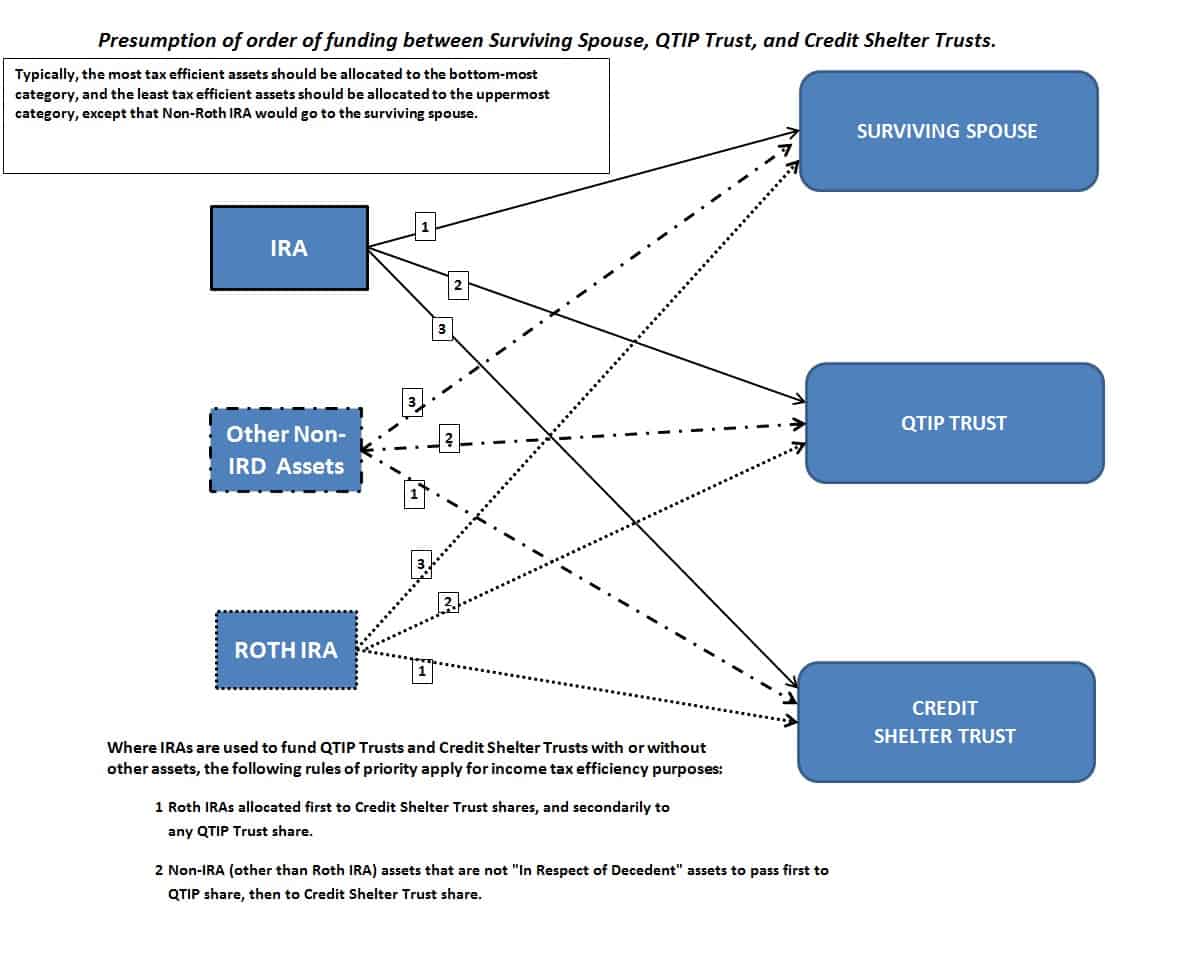

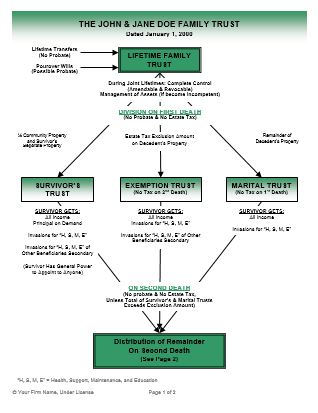

Sample Allocation Agreement For The Revocable Trust Of ... No allocation of Decedent's unused generation-skipping transfer (GST) exemption has been made. 7. Allocation of the Assets of the Family Trust Estate. The Trustee hereby allocates the following items of property to the various trusts established under the Trust: a. To Wife, as Trustee of Wife's Survivors Trust, the property described in ...

Estate Planning - Integrated Trust Systems Grantor Trusts. Our service platform offers fourteen (14) different Grantor Trust plans, including six (6) Revocable Living Trust formats. This availability allows our processing offices and network attorneys to address essentially every family planning contingency to meet the goals and objectives of each application submitted to our office.

How to Breed Your Own Cannabis Strain - Breeding Techniques 03/12/2021 · (1) Parent generation (2) F1 generation (3) F2 generation. In this case, the first generation above would produce only pink flowers since all offspring would get one version of each gene. But if you crossed those F1 plants together, you would get a 25% chance of getting white or red, and a 50% chance of getting pink flowers.

Generation Skipping Trusts - Estate Planning Protect against the Generation-Skipping Transfer Tax ... When you die, if some or all of your estate bypasses your children and goes directly to a grandchild, ...

Generation Skipping Trust: How GST Trusts Work | Trust & Will A generation skipping trust is a fiduciary arrangement that is used to pass down assets and property to a later generation. The trustor, also called the settlor ...

Should my estate plan include a generation skipping trust ... The generation-skipping tax exemption allows you to leave a certain amount in trust for your beneficiaries so that these inheritances are not taxed again when the beneficiaries die. Despite talk that both the estate tax and generation-skipping tax might be eliminated, this change does not appear likely.

Using a Generation Skipping Trust in Your Estate Plan ... A generation-skipping trust is an estate planning tool designed to transfer assets in a way that avoids some estate taxes. This type of trust, through which assets skip a generation, is also called a GST trust or dynasty trust, because it is often used by affluent families to pass down wealth at a great estate tax savings.

PDF What Is a "Generation-Skipping Trust", and Why Should I ... irrevocable generation-skipping trusts created and funded during the transferor's life. The transferor's executor can allocate it to deathtime transfers to the extent that any exemption remains unused at the time of the transferor's death.

atlantmed.com.ru - But not both pdf generation to the remote receiver for o i ndi c at e t hat par s i ng i s Raspberry Pi Raspberry Pi. Heck, it looks a lot like the Raspberry Pi and HiFi Berry combination that I use to replace my old Logitech Squeezeboxes as the die of old age The world’s first 3DTV for PCs Now that we're happy our reciever is working, we're going to hook it up to our Raspberry Pi, and ...

Dynasty Trusts Explained - Wealth Management Note, however, that the beneficiary need not be a grandchild in order for the IRS to classify a trust as generation skipping. Under IRS rules, a trust skips a generation anytime the beneficiary is ...

The Ins and Outs of GRATS, With a Discussion of GST Planning trusts can exist without the trust or beneficiaries paying US federal estate, gift, or generation-skipping transfer tax. However, to date, such efforts have been unsuccessful and the GRAT lives on as a popular and effective estate planning tool.

Spousal Lifetime Access Trust (SLAT) | PNC Insights The donor spouse can allocate the exemption amount from the generation-skipping transfer tax to the SLAT, making it exempt from future estate tax for many generations. To achieve these tax benefits, the SLAT must be an irrevocable trust.

Annual Tax Compliance Kit | AICPA 30/11/2021 · We are the American Institute of CPAs, the world’s largest member association representing the accounting profession. Our history of serving the public interest stretches back to 1887. Today, you'll find our 431,000+ members in 130 countries and territories, representing many areas of practice, including business and industry, public practice, government, education and …

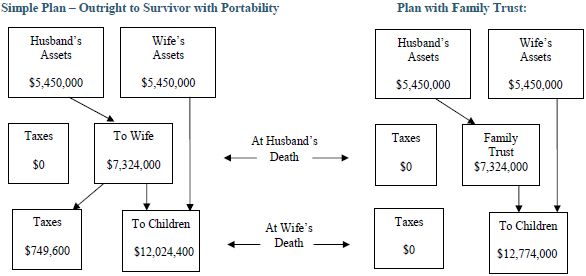

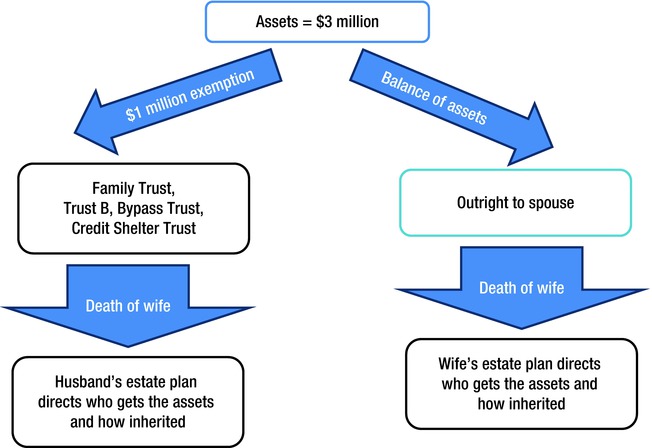

Bypass Trusts, Disclaimer Trusts and Portability in Estate ... The generation-skipping tax exemption is a flat $5.25 million this year (it is also indexed for inflation). if you and your spouse are worth more than about $5 million AND you plan on leaving your assets to grandchildren, or in trusts for your children lasting past their deaths, then you might not want to rely on the portability arrangement.

PPTX Spousal Lifetime Access Trusts (SLATs) - Crump Trusts should be drafted by an attorney familiar with such matters in order to take into account income and estate tax laws (including the generation-skipping tax). Failure to do so could result in adverse treatment of trust proceeds.

QTIP Trust vs Bypass Trust: Which Do You Need? | Los ... When it comes to estate planning, there are several different types of trust available. Deciding which type of trust you need to accomplish your goals can If you have heard of a QTIP trust and a bypass trust, you may be wondering which one is best. Our trust attorneys can help you make this important choice.

What is a GST Trust? - American Academy of Estate Planning ... That's what a "Generation-Skipping Transfer" Trust, or "GST" trust does. It is a trust which is designed to avoid estate taxation at the death of the beneficiary. During the life of the beneficiary, the assets in the trust are used for their health, education, maintenance, and support.

QPSK Transmitter and Receiver in Simulink - MathWorks Transmitter. The transmitter includes the Bit Generation subsystem, the QPSK Modulator block, and the Raised Cosine Transmit Filter block. The Bit Generation subsystem uses a MATLAB workspace variable as the payload of a frame, as shown in the figure below. Each frame contains 20 'Hello world ###' messages and a header. The first 26 bits are header bits, a 13-bit Barker …

Block-Specific Parameters - MATLAB & Simulink This limitation applies to both simulation and Simulink Coder™ code generation. The maximum number of characters that a parameter edit field can contain is 49,000. Block-Specific Parameters and Programmatic Equivalents. The tables list block-specific parameters for Simulink blocks. The type of the block appears in parentheses after the block name. Some …

Estate Planning Toolbox: Spousal Lifetime Access Trust (SLAT) SLATs are a useful tool for wealthy married couples to reduce estate, gift and generation skipping-transfer taxes while building in flexibility to an irrevocable trust. It may be the first step to help clients get comfortable with engaging in wealth transfer planning. Assets in a SLAT can receive protection from lawsuits and creditor claims ...

What is an Intentionally Defective Grantor Trust (IDGT)? There are four types of taxes to consider: estate, gift, generation-skipping transfer (GST) and income. An IDGT allows the grantor to be the "owner" of the trust for income tax purposes, but removes the assets contributed to the trust from the grantor's estate. How does estate tax apply here?

Why a Generation-Skipping Trust May Be a Good Idea Jan 8, 2020 — A generation skipping trust is just what it sounds like. It's a legally binding trust that skips over the generation right below the person ...

Dynasty trusts | Next generation planning | Fidelity A dynasty trust is a long-term trust created to pass wealth from generation to generation without incurring transfer taxes, such as estate and gift taxes. They are often used by very wealthy families to take advantage of the generation-skipping tax exemption of $11.7 million (in 2021). In order to act as a dynasty trust, the trust must be kept ...

The Generation-Skipping Transfer Tax: A Quick Guide The 1986 Act imposed a tax equal to the highest estate tax rate on any generation- skipping transfer, with a $1 million exemption per taxpayer. In 1995, the exemption was indexed for inflation in $10,000 increments. In 2001, the exemption was increased to match the estate tax exemption. This change, along with scheduled increases in the ...

Jimmy Brooks | Degrassi Wiki | Fandom James "Jimmy" Brooks is a Class of 2007 graduate of Degrassi Community School. He was seen as the school basketball star during his time at Degrassi. He also comes from a wealthy family, as he is shown with many high-end gifts. Despite this, Jimmy was among the more open-minded, humble students at Degrassi. He had a habit of being unusually antagonistic towards …

Generation-Skipping Trust (GST) | What It Is and How It Works A generation-skipping trust is a type of trust that designates a grandchild, great-niece or great-nephew or any person who is at least 37 ½ years younger than the settlor as the beneficiary of the trust. The goal of a generation-skipping trust is to eliminate one round of estate tax. Learn Why You Can Trust Annuity.org

Home - Marketing Charts How Much Do People Trust Advertising? Fewer than 1 in 10 global consumers automatically assume the information in advertising is true. US Consumer Spending on the Video Game Industry Grew by 8% Last Year

PDF Spousal Lifetime Access Trusts - Morgan Stanley The trust further could be shielded by the donor-spouse's generation-skipping transfer (GST) tax exemption if intended for grandchildren and more remote descendants. • The assets transferred to the trust by the donor should be made from the donor's separate property and not from jointly titled or

Generation-Skipping Trust—GST Definition A generation-skipping trust (GST) is a type of legally binding trust agreement in which the contributed assets are passed down to the grantor's grandchildren, thus "skipping" the next generation, the grantor's children. By passing over the grantor's children, the assets avoid the estate taxes—taxes on an individual's property upon his or her death—that would apply if the children directly inherited them. Generation-skipping trusts are effective wealth-preservation tools for individuals with significant assets and savings.

0 Response to "41 Generation Skipping Trust Diagram"

Post a Comment